The Time Cycle of Accounting: When you Should Be Evaluating Your Goals

Oct 02, 2020

“Plan for what is difficult while it is easy, do what is great while it is small” -Sun Tzu.

For the busy small business owner neck-deep in new ideas and excited customers, the information going on behind the scenes in the Accounting realm can be a tedious or even anxiety-inducing task. They know the money is coming in, and bills are being paid, but what else? They are left wondering if they have the capital for their dreams of growth and how long their operations are projecting to get them there. Or they may be in an even more daunting place, asking if they have enough money to pay rent that week or a super important vendor. To answer these questions, they can evaluate several areas in their operations throughout the year.

To maintain cash flow and obligations and know your position for growth, having an organized and regularly updated Accounting system is a must. If left neglected, trying to answer basic questions about a business’s financial position can become a robust and expensive task. It can also lead to penalties and other fees if important filing/payment deadlines are not met. While I stress its urgency, monitoring your business’ accounting lifecycle does not have to be as scary as people can build it up to be. Meeting with an Accounting professional can help simplify the process and take as much as you would like from your plate.

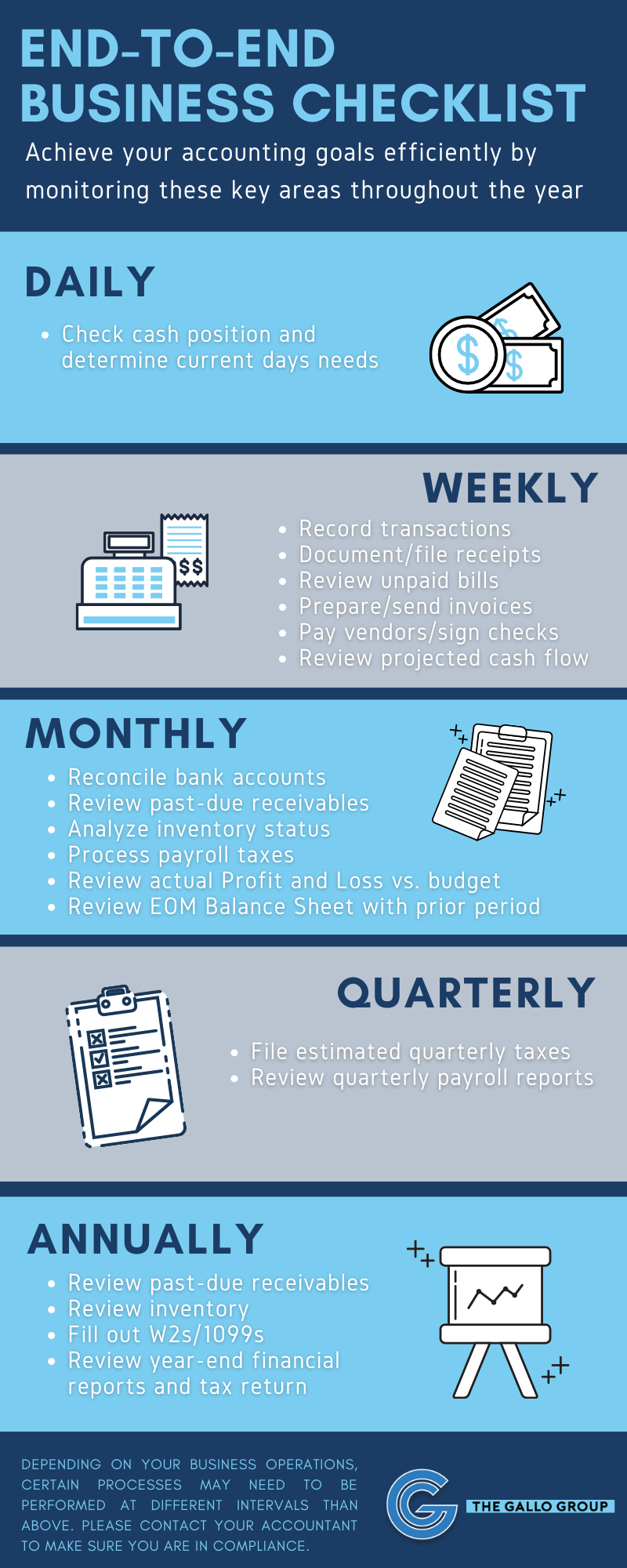

Use this graphic to see what areas you should be evaluating and when.